Introduction

The construction industry is constantly evolving, driven by technological advancements, regulatory changes, and economic fluctuations. One crucial component that plays a pivotal role in ensuring project completion and safeguarding investments is surety bonds. As we look toward the future, understanding the trends and transformations within this sector is vital for stakeholders, including contractors, developers, and bonding companies. In this article, we’ll explore the future of surety bonds in the construction industry, examining their significance, emerging trends, challenges, and opportunities.

What Are Surety Bonds?

Surety bonds are contractual agreements that ensure an obligation will be fulfilled. They involve three parties: the principal (the party required to perform), the obligee (the party that requires the bond), and the surety (usually a bonding company). If the principal fails to meet obligations—whether due to financial issues or performance failures—the surety compensates the obligee.

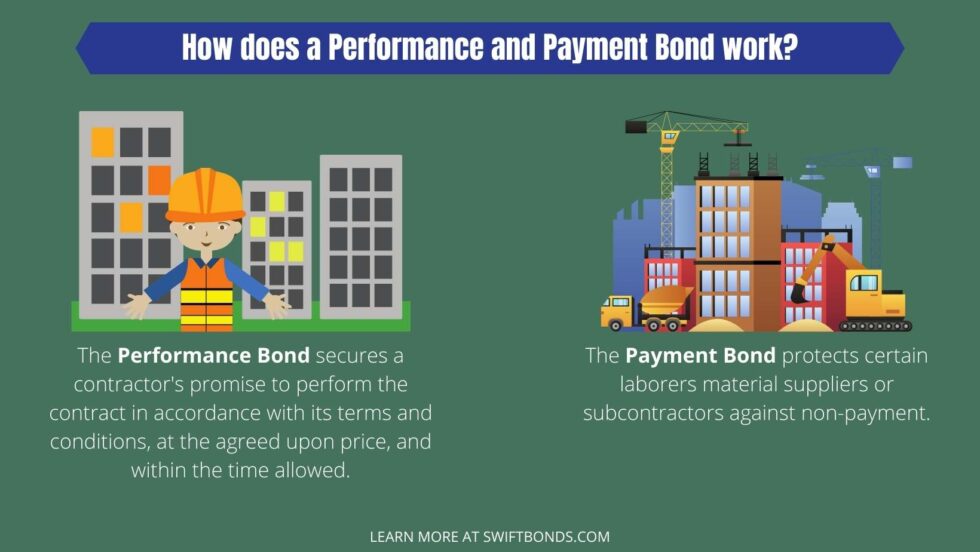

Types of Surety Bonds in Construction

Bid Bonds: Protects project owners from contractor default during bidding. Performance Bonds: Guarantees contract completion according to terms. Payment Bonds: Ensures subcontractors and suppliers are paid. Maintenance Bonds: Covers repairs for a specified period after project completion.How Do Surety Bonds Work?

When a contractor applies for a surety bond, the bonding company assesses their financial history, creditworthiness, and operational capacity. A successful assessment results in bond issuance; if claims arise due to non-performance or payment issues, the bonding company steps in to cover losses.

The Future of Surety Bonds in the Construction Industry

The landscape surrounding surety bonds is shifting rapidly as new technologies emerge and regulations change. To fully grasp what lies ahead for these critical instruments in construction projects, we need to consider various influences shaping their evolution.

Technological Advancements Impacting Surety Bonds

Technology is reshaping how businesses operate within various sectors—including construction and surety bonding.

1. Digital Platforms for Bonding Companies

Bonding companies are increasingly adopting digital platforms to streamline processes related to application submissions and claims management. By harnessing technology:

- Contractors can apply online. Real-time updates on application status become available. Documentation exchange becomes simpler.

2. Data Analytics in Risk Assessment

Data analytics enables bonding companies to assess risks more accurately than traditional methods allowed. By analyzing historical data patterns:

- Bonding companies can identify potential red flags early. They can offer personalized rates based on real-time insights into contractor performance.

3. Blockchain Technology Utilization

Blockchain's introduction into construction contracts promises transparency through immutable records of transactions between parties involved—a boon for both contractors and bonding companies.

Economic Factors Shaping Surety Bond Demand

Economic conditions significantly influence demand for surety bonds within construction:

1. Infrastructure Investments Boosting Demand

Governments worldwide are ramping up infrastructure spending as part of recovery plans following economic downturns or global crises such as pandemics or natural disasters—leading directly to increased requirements for surety bonds on public works projects.

2. Market Volatility Affecting Contractor Stability

Economic instability can lead contractors struggling financially; consequently increasing reliance on performance bonds ensures they fulfill obligations despite challenging market conditions.

Regulatory Changes Impacting Surety Bonds in Construction

As regulations evolve around building codes, environmental standards, labor laws etc., compliance becomes paramount:

1. Stricter Regulations Necessitating More Compliance Bonds

Increased scrutiny over contractor practices will likely lead to higher demand for compliance-based bonds that guarantee adherence to specific laws—ensuring responsible behavior within construction projects.

2. Changes in Licensing Requirements Affecting Bonding Needs

Shifts toward more stringent licensing requirements could compel contractors operating without proper credentials into seeking additional forms of surety coverage—thus changing how bonding companies assess risk profiles and determine eligibility criteria moving forward.

Challenges Facing Surety Bonds Today

While there’s considerable promise regarding advancements tied directly with modernizing approaches toward issuing/reviewing said instruments—several hurdles remain:

1. Claims Management Complications

Processing claims efficiently remains a challenge due primarily because discrepancies often occur regarding scope/extent of damages incurred during contract breaches unless all parties maintain transparent communication throughout project execution phases—creating friction between principals/subcontractors/bond providers alike when disputes arise over who bears responsibility ultimately leading back down chain towards resolving issues amicably before litigation ensues.

2. Understanding Policy Terms & Conditions Properly

Complexities inherent within policy documents often make it difficult bonds for licenses and permits even seasoned professionals navigate intricacies associated with coverage limits/exclusions; consequently leading misunderstandings which could cost clients dearly should incidents arise necessitating re-evaluation terms agreed upon previously prior initiating work on-site itself!

3. Balancing Risk vs Reward Relationships Effectively Over Time Periods Specified Within Contracts Signed Off Initially By All Interested Parties Involved At Every Level Throughout Process Lifecycle Until Completion Achieved Successfully Without Unforeseen Hiccups Arising Along Way!

Opportunities for Growth with Surety Bonds Moving Forward

Despite challenges faced currently existing landscape presents numerous opportunities ripe for exploration:

1. Expanding Awareness Among Stakeholders Regarding Benefits Offered By Utilizing Such Instruments Available Through Reputable Bond Providers Who Specialize In This Field Specifically Tailoring Offerings According To Client Needs Based On Their Unique Situations!

By promoting education surrounding advantages provided via securing appropriate levels protection afforded thereby maximizing peace mind knowing backed professionals experienced handling affairs expertly navigating waters safely steering clear pitfalls lurking beneath surface ready strike unexpectedly where least expected indeed!

2 . Enhanced Collaboration Between Parties Engaging Directly With Each Other Throughout Project Phases Ensuring Clear Communication Channels Remain Open At All Times Facilitating Smooth Operations Ultimately Leading Greater Success Rates Overall Clients’ Satisfaction Levels Exceed Expectations Set Initially Prior Commencing Works Together!

FAQs About Surety Bonds

1. What is the primary purpose of a surety bond?

Surety bonds assure project owners that contractors will fulfill their obligations license and permit bonds as per contract terms; if not fulfilled, claim payments made by bonding companies compensate affected parties accordingly.

2. How does one obtain a surety bond?

Typically through applying directly with a reputable bonding company providing necessary documentation detailing financial history/business operations showcasing capability meeting criteria outlined beforehand enabling bond issuance once approved successfully!

3 . Can any contractor get bonded easily without background checks?

No! Bond approval involves rigorous assessments conducted evaluating creditworthiness/past performances ensuring responsible behavior exhibited before being granted access requested capital necessary fulfilling obligations stipulated under contracts signed off initially!

4 . What happens if my bond claim exceeds its limit?

Should claims exceed limits established under policies issued previously those amounts would typically not be covered leaving clients liable pursuing alternative remedies viable according circumstances dictated at time occurrence event transpired requiring action taken swiftly avoid further complications arising afterwards potentially causing delays add costs unnecessarily onto overall budget constraints established beforehand!

5 . Are there different rates associated with varying types of contracts entered into by firms applying coverage through respective insurers?

Yes! Rates may vary depending upon nature/size/scope involved among other factors relating specifically targeted industries served thereby creating unique pricing structures tailored fit individual client needs walk-through driven processes facilitating smooth transitions from proposal stage right through completion phases effectively maintaining oversight throughout entire lifecycle operations undertaken together ensuring nothing overlooked along way keeping everything flowing seamlessly onward towards desired outcomes achieved collectively!

Conclusion

The future of surety bonds in the construction industry looks promising yet complex amid shifting landscapes influenced by technology advancements/economic fluctuations/regulatory changes alike driving discussions forward amongst stakeholders focused improving efficiencies while safeguarding interests involved all parties concerned! As we move forward into this transformative era filled possibilities ahead collaborating closely maintaining open lines communication fostering trust gaining deeper insights into operational dynamics underpinning success stories unfolding daily; embracing innovation adapting accordingly will be key determining whether not firms thrive flourish amidst challenges presented along journey ahead navigating uncertainties purposefully guided principles integrity excellence maintained high standards consistently applied across board ensuring positive outcomes achievable ultimately benefiting everyone engaged process from start finish line reached victoriously together hand-in-hand shared goals realized fully satisfaction levels attained beyond expectations set forth initially!